New Delhi, May 8, 2024 : With supply-side investments on both physical and digital infrastructure, Indian economy is better placed to pursue non-inflationary growth and could achieve a GDP growth rate of above 7% this year, based on its domestic strengths, Chief Economic Advisor to the Government Dr V Anantha Nageswaran said at an event organised by the National Council of Applied Economic Research (NCAER) here on Wednesday.

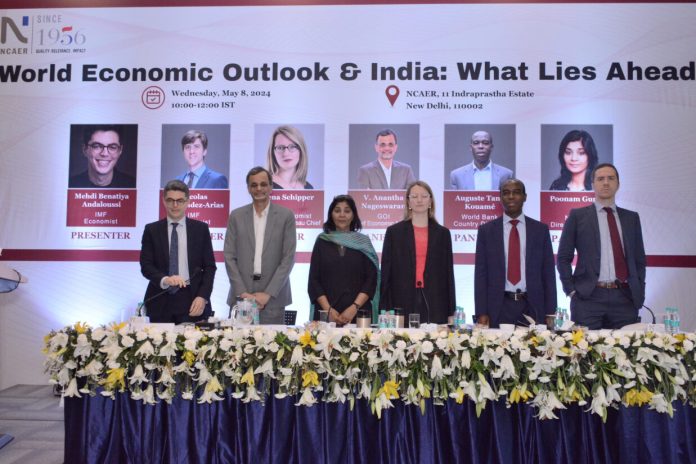

“We need to recognise the geo-political and geo-economic context. We can achieve moderate to high growth over a long term … Small and medium sector is the backbone. We need them to grow their share in manufacturing. We also need to strengthen the supply-side infrastructure to have longer economic cycles and prevent overheating of the economy every 4-5 years, besides having financial inclusion, skilling, and electricity reforms,” said Dr Nageswaran while participating in a discussion on “World Economic Outlook & India: What Lies Ahead”.

NCAER Director General and member of Economic Advisory Council to the PM (EAC-PM) Dr Poonam Gupta said, “The IMF has projected acceleration in global growth and world trade volumes, decline in inflation rates, and oil prices to remain around the current levels. Based on its domestic strengths and a favourable global outlook, the Indian economy may be expected to grow at 7 plus rate this year and next.”

More importantly, she pointed out that India’s population growth rate had slowed down from 2.1% in the 1990s to almost 1% now, thus, translating GDP growth into bigger per capita income.

Dr Gupta said India’s GDP growth rate has become more resilient due to macroeconomic stability with various shocks, which mattered in the past, impacting it much less now. “With clear electoral verdicts, policy risks have become less; agriculture has been decoupled from rainfall; large forex reserves have blunted effect of flight of capital due to any global disruption; and cleaning up of the financial sector has led to faster credit growth,” she said.

Earlier asked about inflation, Dr Nageswaran said, “With above normal monsoons, it is expected to come to the mid-point (4%) of the RBI’s target range. We don’t see at the moment any scope for nasty upside surprises yet there can always be scenarios in geopolitics that cause the inflation to spike.”

Dr Gupta also noted that despite fiscal deficit and public debt remaining high in India, their quality had improved. She suggested that instead of reducing government expenditure, the focus ought to be on enhancing “expenditure efficiency” and increasing revenue.